Mesothelioma and Asbestos Trust Funds

Mesothelioma trust funds are accounts with large sums of money set up by bankrupt asbestos companies to compensate asbestos victims. The funds provide compensation for people diagnosed with asbestos-related diseases. An experienced mesothelioma lawyer can help you file a claim for compensation.

What Are Mesothelioma Trust Funds?

An asbestos trust fund is an account set up to compensate those with mesothelioma caused by asbestos exposure. Asbestos manufacturers created these trust funds through Chapter 11 bankruptcy protection. Claimants use the compensation to pay medical bills, make up for lost wages and afford funeral costs.

Companies that manufacture asbestos-containing products have faced numerous lawsuits from people who became ill from asbestos exposure. The large number of asbestos claims forced many companies to declare bankruptcy. As a condition of their bankruptcy, these companies created trust funds to manage current and future asbestos claims.

Those with mesothelioma who were exposed to asbestos by their employer should discuss their eligibility with a lawyer. Eligible claimants can include those exposed secondhand, such as household members. Family members who lost a loved one from asbestos exposure can also file a claim.

Who Is Eligible to File an Asbestos Trust Fund Claim?

Certain people who were exposed to asbestos and developed mesothelioma or another asbestos-related disease as a result of exposure to asbestos products made by the company that created the fund can tap into these funds.

People eligible to submit a trust fund claim:

- Workers exposed to asbestos by their employer

- People who used asbestos-containing products

- Family members who lost a loved one from asbestos exposure

A mesothelioma attorney can let you know if you qualify. They can investigate your asbestos exposure history to determine which companies are liable. People with mesothelioma or their estate members may be able to file claims with more than one trust fund.

Key Facts About Mesothelioma Trust Funds

- Of the more than $40 billion contributed to asbestos trust funds, there was an estimated $25 billion left in 2016, according to the most recent report.

- Asbestos trust fund payouts range from $7,000 to $1.2 million with a $180,000 median value for mesothelioma claims.

- More than 60 active asbestos trust funds set aside $30 billion for future asbestos claims.

- These trusts paid claimants nearly $25 billion between 2004-2016, according to the U.S. Chamber Institute of Legal Reform.

Filing Limitations for a Mesothelioma Trust Fund Claim

Laws and courts have established limits on how long people have to file claims with asbestos trust funds. Regulations also differ by state regarding how trust fund claims impact lawsuits.

Variables to Discuss With Your Lawyer

- Statutes of Limitations: A trust fund claim must fall within the time limit set by each trust. Each trust sets its limits for filing a claim. This period is generally around two to three years after a mesothelioma diagnosis.

- State Laws: The federal government allows states to form their asbestos legislation. State laws dictate how compensation affects the determination of lawsuit awards.

- Setoffs: Those who have received a trust payout may get only partial payment from a court award. Some states may permit setoffs for trust payments. These states include Illinois, New York, Texas and West Virginia.

- Filing Multiple Claims and Lawsuits: In some cases, claimants can file asbestos trust claims and lawsuits. Various state laws require claimants to disclose information about other claims they may have reported in the past.

- Information Sharing: State courts have different rules about sharing trust claim information with lawsuit defendants. Some courts require disclosure of any claims submitted to trusts during the discovery phase of a lawsuit.

Before filing a trust fund claim, you should know all your legal options. A qualified mesothelioma lawyer can help you navigate this process. They’ll determine if filing an asbestos trust fund claim is right for you.

Compensation from Mesothelioma Trust Funds

The scheduled value for asbestos trust fund payouts ranges from $7,000 to $1.2 million, according to the most recent available research by Rand. The median value for mesothelioma claims is $180,000.

Factors That Impact Asbestos Trust Fund Payouts

- Type of asbestos-related disease

- Payment schedule the trust established

- Current payment percentage for the trust

Mesothelioma trust fund claims often pay six figures, according to a 2016 Mealey’s Asbestos Bankruptcy report. The amount of compensation for mesothelioma a claimant can receive from an asbestos trust depends on the payment percentage and other factors.

Each asbestos trust assigns claim values to a mesothelioma, lung cancer and asbestosis diagnosis. Mesothelioma claims receive higher payouts. This “schedule” involves many factors. One usual example is how much the company paid per claim before filing for bankruptcy.

How Much Money Is Left in Asbestos Trust Funds?

About $25 billion was left in asbestos trust funds in 2016, which is the most recent estimate available in a 2018 report by the U.S. Chamber Institute for Legal Reform. The actual amount is difficult to determine because several new trusts have formed since then, and funding obligations continue to replenish active trusts.

About 60 asbestos trust funds remain active. These trusts paid claimants nearly $24 billion between 2004 and 2016 alone. Trusts are established after rigorous estimation proceedings. These proceedings determine how much money should be set aside for current and future asbestos claims. Management procedures are established to ensure the funds last long enough to compensate future claimants.

How Do Trust Fund Payment Percentages Work?

Trust funds offer a set payment percentage of a claim’s value to preserve money for future patients who will be diagnosed years from now. Trust administrators evaluate the percentage regularly to ensure enough funds remain for future claims.

For example, for a claim worth $180,000 (the median value for mesothelioma claims), if the trust’s payment percentage is 25%, the payout would be $45,000. That compensation may be substantial enough to help cover medical bills and lost wages.

Use our calculator to quickly understand what compensation you may be eligible for and understand your rights — all at no cost to you.

List of Asbestos Trust Funds

Dozens of asbestos companies set up trust funds including Johns Manville, W.R. Grace and United States Gypsum. There are billions of dollars in these funds to compensate future asbestos victims. The following is a list of asbestos trust funds available to mesothelioma patients and their families.

| Company | Estimate of Initial Assets | Year Established |

|---|---|---|

| United States Gypsum Trust | $3.9 billion | 2006 |

| Owens Corning Corporation Trust | $3.4 billion | 2006 |

| Pittsburgh Corning Corporation Trust | $3.4 billion | 2011 |

| W.R. Grace and Co. Trust | $2.9 billion | 2001 |

| DII Industries Trust | $2.5 billion | 2005 |

| Johns-Manville Corporation Trust | $2.5 billion | 1988 |

| Armstrong World Industries Trust | $2 billion | 2006 |

| Western Asbestos (Western MacArthur) Trust | $2 billion | 2004 |

| Babcock & Wilcox Trust | $1.8 billion | 2006 |

| Owens Corning Fibreboard Subfund Trust | $1.5 billion | 2006 |

Dozens of asbestos companies set up asbestos bankruptcy trusts to compensate future asbestos claimants. Companies such as Johns Manville, W.R. Grace and United States Gypsum contribute to the billions of dollars that are available to people with asbestos-related diseases and their families.

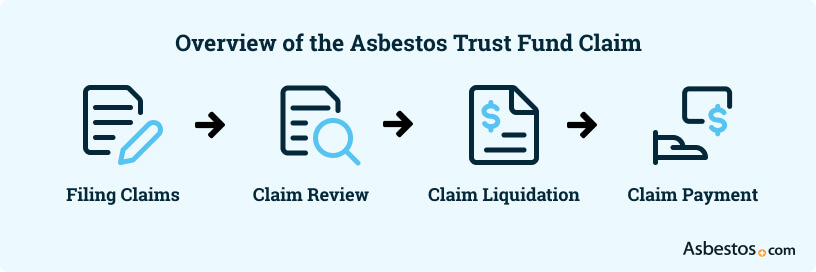

How to File an Asbestos Trust Fund Claim

You must be eligible and provide evidence to file an asbestos trust fund claim. The first step is to meet the fund’s eligibility criteria. Next, your lawyer will gather the evidence before filing the claim.

Finding a lawyer with experience in asbestos trust fund claims is essential. They will guide you through these steps to give you peace of mind and let you focus on your recovery.

Step 1: Meet Trust Fund Criteria

Each asbestos trust fund sets its criteria that potential claimants must meet to file a successful claim. The trust fund’s website typically outlines the requirements.

Common Asbestos Trust Fund Criteria

- When your asbestos exposure occurred

- Where the exposure took place

- Proof of an asbestos-related diagnosis

- Information or evidence about the asbestos products you were exposed to

- Statute of limitations for filing a claim

The criteria changes depending on many factors. These can include the place of exposure, the types of products involved and when the company used asbestos products.

Step 2: Collect Evidence to Support Your Claim

You will need to gather evidence to support your claim. Your asbestos attorney and their team will help you and conduct investigations.

Evidence Typically Required

- Patient’s Diagnosis: Medical documentation proving an asbestos-related diagnosis, generally pathology reports and imaging scans

- Evidence of Exposure: Evidence confirming asbestos exposure to a particular product or place, which may include witness affidavits, employment records and invoices

- Asbestos Involvement: Medical documentation describing the extent to which asbestos contributed to the claimant’s disease

Research into your work history is an important part of the process. You’ll also work with your medical team to gather diagnosis reports and other health information.

Step 3: Submit Your Claim

Once your attorney has gathered evidence, they will submit it per the asbestos trust’s protocols. Most trusts accept claims submitted through their websites.

To receive compensation from asbestos trust funds, it’s essential to have a lawyer who knows the ins and outs of asbestos litigation.

Other trusts may require the submission of a printed claim through the mail. Your attorney will find the best method to submit your claim to ensure a smooth approval process.

Step 4: Claim Reviewed for Approval

Asbestos trust funds have separate review processes for claims based on an individual’s asbestos exposure and particular life situation. Make sure to inquire with the trust’s administrators or ask your attorney to explain the process. The trust’s administrators will review the evidence in your claim.

Evidence Review Processes

- Expedited Review: Your claim will be grouped based on your diagnosis. This allows trust administrators to review the claims more quickly. A fixed payment amount is associated with an expedited review. Claimants typically receive payment faster than with an individual review.

- Individual Review: The administrators will individually review your claim. This takes longer than an expedited review. They consider more factors in an individual study, such as the extent of your disease and how many dependents you have. The payment amount could be higher or lower than the fixed amount associated with an expedited review.

Claimants diagnosed with terminal diseases, such as mesothelioma, who need compensation fast may consider an extraordinary claim. This is a good option for claimants who meet the criteria for an expedited review and whose exposure was from a single product or employer.

The settlement offered in this review may move to arbitration if the claimant is unsatisfied with the settlement amount. If arbitration fails, claimants may have a right to sue the trust. An experienced mesothelioma attorney has the expertise to know which type of asbestos trust fund review is likely to result in a better outcome for your case.

Start filing your claim today so you and your family get the compensation they deserve.

Start Your ClaimHow Are Asbestos Bankruptcy Trusts Created?

Mesothelioma trust funds are generally created through Chapter 11 bankruptcy courts. These trusts usually hold enough money to pay for future claims.

Some companies were not sufficiently financially sound to establish a trust fund. They instead filed for Chapter 7 bankruptcy liquidation. Through reorganization, they sold off assets, and courts distributed money to claimants.

Creating Asbestos Bankruptcy Trusts

- Plan Submission: Some companies can’t afford to pay asbestos liabilities. They must submit plans to a bankruptcy court for reorganization. These plans include how much will go into the trust for asbestos claimants and creditors.

- Estimates Established: The court holds estimation proceedings, which resemble court trials. Each interested group estimates how much should go into the trust. They also include testimony from experts knowledgeable about the value of past asbestos lawsuit settlements.

- Judge’s Approval: The bankruptcy judge weighs the evidence, including the estimates and expert testimony. Once approved, the company transfers the money to a trust fund, and a trustee manages the trust.

- Trustee Management: An appointed trustee manages the trust and the claimant process. They ensure that enough funds are available to future claimants. Trustees must provide annual reports on the financial state of the trust.

Mesothelioma patients may be able to file claims against one or more trusts. The process requires medical records, often a physician statement and asbestos exposure summary. An experienced asbestos lawyer will provide a list of asbestos bankruptcy trusts. They can also help you navigate the trust fund process.

Trust funds are available to help people with all types of asbestos-related diseases. Mesothelioma claims usually result in the highest compensation.

Asbestos Bankruptcy Trust Fund Regulation

The federal government monitors asbestos trust funds and how they disburse money. The Furthering Asbestos Claim Transparency Act is one example of attempted federal regulation. It has drawn criticism from plaintiffs’ lawyers and support from defendants’ lawyers.

The FACT Act would make asbestos trust funds report their payouts. Some critics state it would put claimants’ personal information in a public database. The bill has stalled in the legislature without action since 2017.

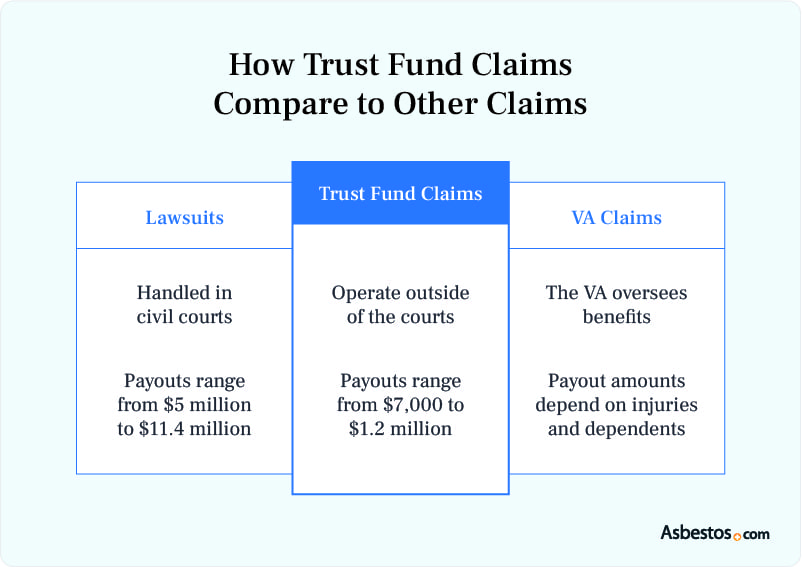

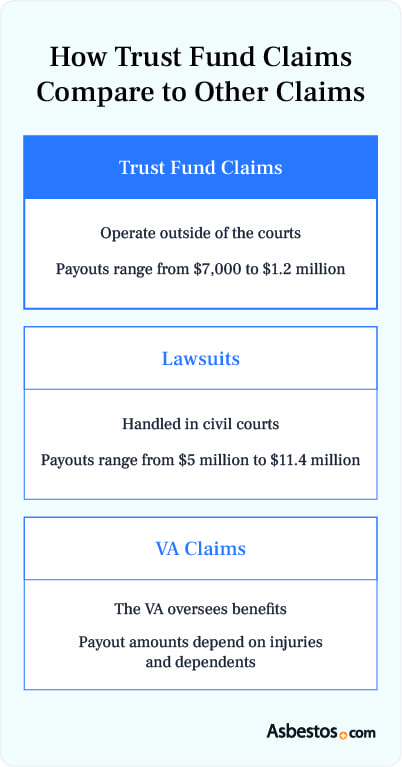

How Do Asbestos Trust Fund Claims Compare to Other Mesothelioma Claims?

Asbestos trust fund claims differ from lawsuits and VA claims. However, they can still pay significant compensation to people injured by asbestos products.

Compensation from lawsuits comes through settlements or jury verdicts. Trust funds, on the other hand, protect bankrupt asbestos companies from future asbestos lawsuits. The trust fund handles future claims rather than the reorganized company. The process is largely administrative.

Veterans are eligible for veterans’ benefits and claims. VA claims are not legal claims. They offer compensation and health care to veterans of the U.S. armed forces and their families.

Those affected by asbestos also have other options for compensation. These options include asbestos lawsuits, Social Security Disability Insurance and personal insurance. A qualified mesothelioma law firm can help you determine your legal options.

Common Questions About Asbestos Trust Funds

- Will I need an attorney to file a mesothelioma trust fund claim?

-

It is best to have an attorney file claims with the asbestos trusts, given the unique exposure and medical evidence necessary to successfully pursue a mesothelioma case with the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- What are the pros and cons of filing an asbestos trust fund claim versus a lawsuit?

-

That is a question best answered by your mesothelioma attorney after discussions about your exposures and other variables.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- Is asbestos trust fund compensation taxable?

-

Compensation from the asbestos trusts is not taxable.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- How much is the average trust fund claim payout?

-

There is no average payout for claims against the asbestos trusts. Any compensation is determined by the evidence obtained against the asbestos companies in which claims were filed against the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

- Can a family member file an asbestos trust fund claim?

-

The mesothelioma victim, spouse, children, and heirs can file claims against the asbestos trusts.

Answered By: Carl Money, Mesothelioma Attorney, Nemeroff Law Firm

This Page Contains 4 Cited Articles

The sources on all content featured in The Mesothelioma Center at Asbestos.com include medical and scientific studies, peer-reviewed studies and other research documents from reputable organizations.

- Mealey's. (2022, December 12). Bankruptcy Judge OKs Honeywell’s $1.32B Buyout Deal With NARCO Asbestos Trust. Retrieved from https://www.lexislegalnews.com/mealeys/articles/1673707/bankruptcy-judge-oks-honeywell-s-1-32b-buyout-deal-with-narco-asbestos-trust

- U.S. Chamber Institute for Legal Reform. (2018, March). Dubious Distribution Asbestos Bankruptcy Trust Assets and Compensation. Retrieved from https://instituteforlegalreform.com/research/dubious-distribution-asbestos-bankruptcy-trust-assets-and-compensation/

- Rand. (2015). Bankruptcy Trusts Complicate the Outcomes of Asbestos Lawsuits. Retrieved from https://www.rand.org/pubs/research_briefs/RB9830.html

- Dixon, L., McGovern, G. & Coombe, A. (2010). Asbestos Bankruptcy Trusts: An Overview of Trust Structure and Activity with Detailed Reports on the Largest Trusts. Retrieved from https://www.rand.org/content/dam/rand/pubs/technical_reports/2010/RAND_TR872.pdf

-

Current Version

-

January 2, 2025Written BySamuel MeirowitzEdited ByWalter Pacheco